The central banks are responsible for cash reserves and for releasing money into the economy. As a result, they are in charge of monetary policy. Typically, when economic activity is low, central banks inject liquidity into the economy in question to give it a boost. This happens through credit – the type of credit you take out from your bank – which means consumers must be incentivized to borrow money. This results in low interest rates and also leads to inflation, so you need more money for your everyday purchases. A little inflation hurts no one… so long as wages follow suit. But nowadays, neither wages nor savings products follow along with inflation.

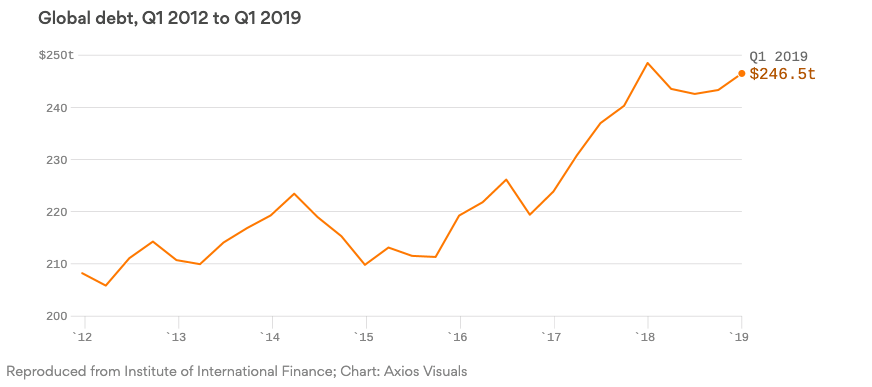

In and of itself, inflation should not be a cause for worry (at least, not in Europe). Although in France we may be annoyed that our savings accounts are losing us money, as they are frozen at 0.75% (in France) while inflation continues to rise, that is not what is most alarming. No, the real problem is that the ECB (European Central Bank) persists in applying a strategy of paltry policy interest rates, so much so that France is now taking out 10-year loans at negative rates. Although some are delighted with this news (“Hooray! France is being paid to borrow money!”), let us not forget that France’s debt currently stands at €2,358.9 billion, or 99.6% of GDP. As for world debt, it now totals US$246.5 trillion, or 360% of global GDP. Of course, with interest rates below 0%, it is easier to repay debt… but it is also more tempting to borrow more.

On the one hand, as mentioned above, because policy interest rates affect commercial banks’ interest rates, this can be advantageous: for example, mortgages are offered at unprecedentedly low rates. However, at no time has the ambition for these rates hovering around 0% come to fruition: that of encouraging consumption to improve economic activity and circulating money in the real economy. First, Europeans are well-known as savers. Second, wages have not followed in line with rising prices. Third, it was too late when the ECB launched this policy (the European crises had already shaken many countries within our economic area).

Above all, it is important to remember that low policy interest rates are a sign of an economy which is doing poorly: they are an indication of an economy in need of recovery measures. Over the long term, this is a bad thing (just think of Japan, where public debt is twice as high as the rest of the world, as a result of Shinzo Abe’s economy policy, dubbed “Abenomics”), because the currency loses value, so investors who have stopped making money lose interest in it.

The Fed recently adopted the same strategy: pressured by Trump and by the appearance of signs of an economic slowdown, the Fed finally gave in and announced that it was probably going to complete reverse its monetary policy. For a president who claims to have “made America great again”, this decision to “cut” rates is in fact an expression of a degree of insecurity… And the proof is in: the NABE (National Association for Business Economics) estimates the risk of recession in the US in 2020 at 60%. The official rates were announced on 31 July, down 0.25 points, resulting in rates below 2.25%.

As a result, at a time when all fiat currencies are showing real signs of weakness as they lose their value, year after year, the value of gold continues to climb (or, at worst, stagnate). The reason why gold was used as a monetary instrument for millennia is no mystery: it is the only instrument today to offer such stability. If the transition to paper money was completed more than 40 years ago, this was done in a context of globalization: although the 1944 Bretton Woods Agreement instituted American hegemony by backing the dollar (and only the dollar) – the necessary currency for international trade – against gold, the situation was reversed in 1971, and then officially in 1976, with the Jamaica Accords. In fact, on the one hand, the States benefited from letting currency prices float and, on the other, the United States suspended the convertibility of the dollar into gold, out of a desire to preserve the country’s gold reserves after a request from the German Federal Republic which found itself in a situation of hyperinflation.

As a result, at a time when all fiat currencies are showing real signs of weakness as they lose their value, year after year, the value of gold continues to climb (or, at worst, stagnate). The reason why gold was used as a monetary instrument for millennia is no mystery: it is the only instrument today to offer such stability. If the transition to paper money was completed more than 40 years ago, this was done in a context of globalization: although the 1944 Bretton Woods Agreement instituted American hegemony by backing the dollar (and only the dollar) – the necessary currency for international trade – against gold, the situation was reversed in 1971, and then officially in 1976, with the Jamaica Accords. In fact, on the one hand, the States benefited from letting currency prices float and, on the other, the United States suspended the convertibility of the dollar into gold, out of a desire to preserve the country’s gold reserves after a request from the German Federal Republic which found itself in a situation of hyperinflation.

Whatever the future may hold, this announcement has benefited gold because, on 19 July 2019, the price of gold was at its highest in six years: $1,450 per ounce (a record which was beaten in early August). This can simply be explained by the fact that investors have lost interest in bonds, that no longer offer any returns, in favour of gold, whose intrinsic value continues to provide reassurance in any situation, especially during recessions and economic crises.

Gold compared to fiat currency

As a result, at a time when all fiat currencies are showing real signs of weakness as they lose their value, year after year, the value of gold continues to climb (or, at worst, stagnate). The reason why gold was used as a monetary instrument for millennia is no mystery: it is the only instrument today to offer such stability. If the transition to paper money was completed more than 40 years ago, this was done in a context of globalization: although the 1944 Bretton Woods Agreement instituted American hegemony by backing the dollar (and only the dollar) – the necessary currency for international trade – against gold, the situation was reversed in 1971, and then officially in 1976, with the Jamaica Accords. In fact, on the one hand, the States benefited from letting currency prices float and, on the other, the United States suspended the convertibility of the dollar into gold, out of a desire to preserve the country’s gold reserves after a request from the German Federal Republic which found itself in a situation of hyperinflation.