The health crisis of the last two years and the current geopolitical turmoil over the war in Ukraine have once again demonstrated that gold is a safe haven that helps preserve the purchasing power of one’s assets despite the turbulence of the traditional financial markets. But for many savers, the question that comes up most often is whether it is the right time to buy. While this question might be meaningless for some and of utmost importance to others, there is actually one answer : DCA.

It is impossible to predict the right time to buy gold

Since the reference value of an ounce of gold is set in dollars, it would be logical to buy it at the lowest price, in order to benefit from the maximum potential gain in value when reselling. Except that you never know when this will happen. And even if you manage to buy gold at a time when the price is falling, there is no guarantee that it will not fall even lower after the purchase. Furthermore, there may very well be times when you need to liquidate your precious metal holdings to make up for losses in other lines of your portfolio, when the gold price is not favourable. This is for example what happened at the end of 2018, when the equity markets failed to recover after a 15-20% loss in the last quarter, but the gold price was also at its lowest levels in the last 5 years.

In short, it is impossible to correctly anticipate market movements with the often futile hope of being optimally positioned. To make matters worse, when unexpected events such as a pandemic, natural disaster or war suddenly push up the price of gold, usually in response to the deterioration of other traditional markets (but as we have seen, not always), then it is too late for those aiming for the best price. As the price of gold fluctuates according to investors’ feelings of financial insecurity, only the very first to sense the trend will be able to take advantage. They will be the ones to refuge in the purchase of precious metals, which will automatically push the price up as the demand increases. All other buyers will be doomed to follow the trend, having arrived too late anyway.

Buy regularly to smooth out performance

The solution is to not only disconnect your buying decision from the price level, but also from the emotions that often drive you to make bad decisions based on market movements. This is precisely what DCA (Dollar-Cost Averaging) allows, which consists of buying gold on a regular basis, preferably in small quantities each time, in order to benefit from the best possible smoothing effect in terms of the purchase price in dollars.

To be clear, the wisest investor is one who buys a little bit of gold at regular intervals, regardless of its price. In this way, not only do they increase their chances of buying at the right time, but also minimize the weight of any negative movements since it will apply to limited quantities of metal. And as these quantities will be the same as those that benefited from the best buying prices, the positive and negative movements will balance each other out. It can even be assumed that the long-term average will be positive because, statistically, drops are generally more abrupt than rises, and they are also less frequent.

Exactly how do I do this?

All you have to do is determine the amount of money you want to spend on gold, each month or each year for example, in the same way as you would for a savings account with fixed amounts of money. The easiest way to do this is to program an automatic transfer to a service provider, such as VeraCash, which will convert your euros into precious metals at the daily rate* in a dedicated account.

This way, for the same amount of money, you will buy less metal when prices are rising – minimising your exposure to risk, but you will buy more when prices are falling – maximising your potential for future gains.

DCA, the path to a resilient investment

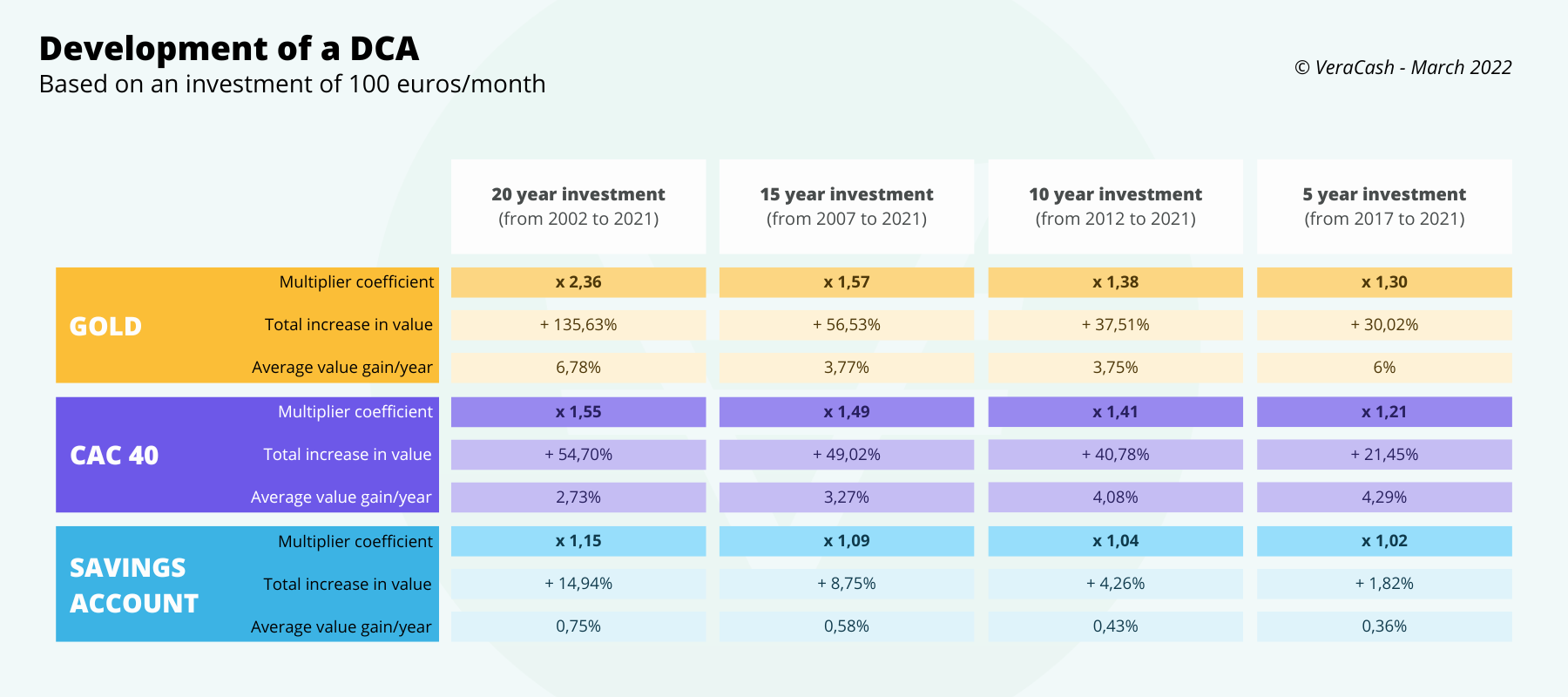

The DCA technique is the one that allows you to obtain the best results in the medium and long term because it focuses not on price variations but on the underlying trend. And this is a good thing, because even though gold does not offer any return in the strict sense of the word, its value is constantly rising to keep pace with inflation. In fact, its price has risen faster than the cost of living over the past 50 years, in other words, since the gold standard was abandoned as the basis for setting the value of currencies.

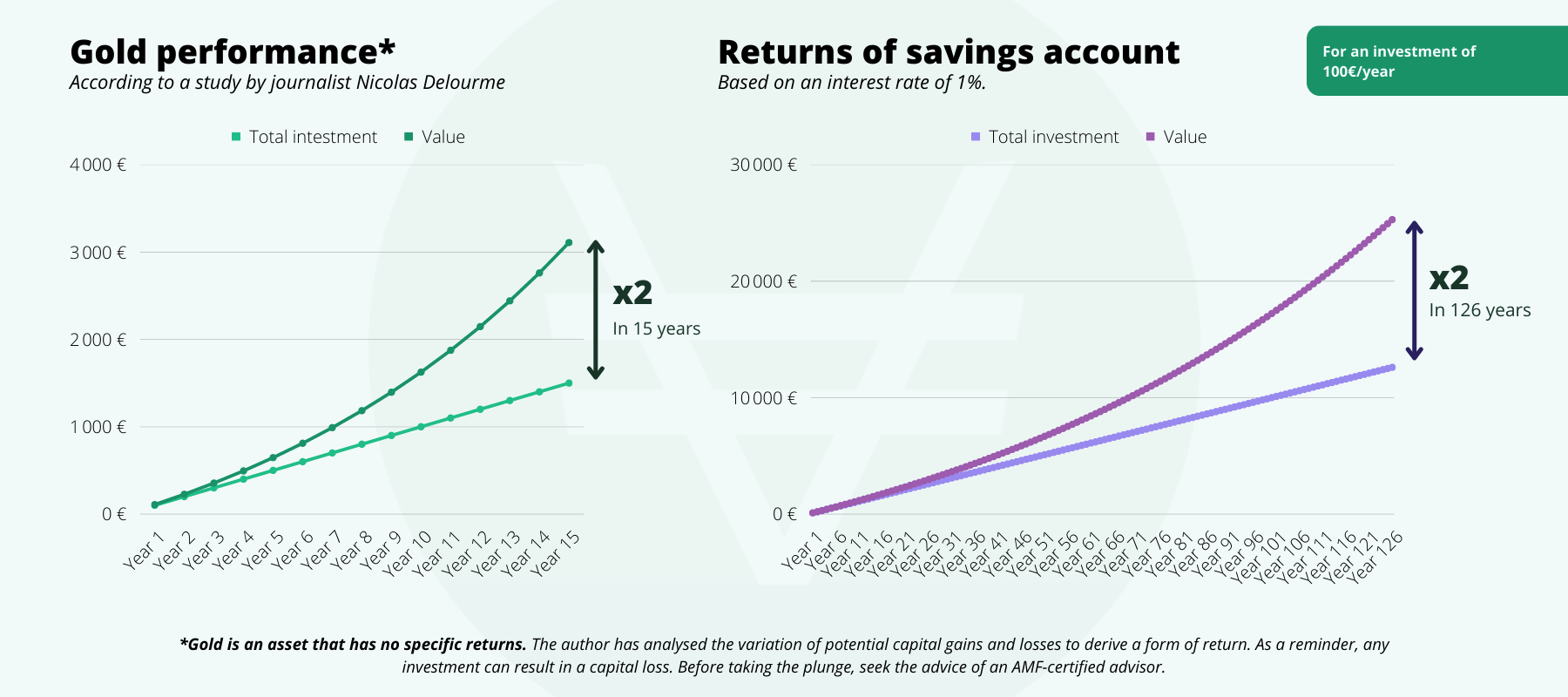

Since 2000, it has been calculated that buyers of physical gold have gained an average of 8.67% per annum, regardless of the year of purchase or resale. This means that if you buy gold regularly and don’t worry about short-term fluctuations, you can expect to double the amount you invest in about 15 years. You would need about 130 years to achieve the same result with a savings account at 1%…

*Your account credit depends on the method of payment of the funds:

- In the case of a standard transfer, the processing time for your transaction corresponds to the inter-banking timeframe of 48/72 hours.

- In the case of an instant transfer, your transaction is credited in a few minutes.

I have been a web entrepreneur since 1999. After graduating from the Bordeaux School of Journalism, I was a radio reporter for 10 years. I run several social media and blogs on business, tech, finance and digital marketing.

You might be interested in

21 February 2023

Could inflation be both the problem and the solution?

Rising prices are undoubtedly the indicator that speaks loudest to the most people. Depending on geographic location and position in the economic…

7 October 2020

Nine good reasons to invest in gold

Gold has been shining brightly for the past few months. It even set a new all-time high this summer at over $2,000 an ounce. Can investing in gold in…