24 December 2025

Gold price in 2025: still rising, say experts

After a year of record gold prices, will they continue to rise in 2025? For most analysts, the answer is yes? We explain.

23 October 2023

Internet payment security: everything you need to know about PSD2 and strong authentication

This new European Directive for Internet payment service providers (PSD2) aims to provide consumers with even greater protection against the risk of electronic payment fraud. The aim of this European…

20 October 2023

A future gold currency for BRICS?

Although BRICS share the ambition of reshaping the world order and challenging the monopoly of the dollar with a gold currency, they have a long way to go...

22 March 2022

Bank run: Do we need to worry about a wave of banking panic?

At the moment, there is a new wave that is not talked about as often : the banking panic or 'bank run'. However, it is a risk that is directly correlated to the loss of confidence in a commercial…

7 August 2019

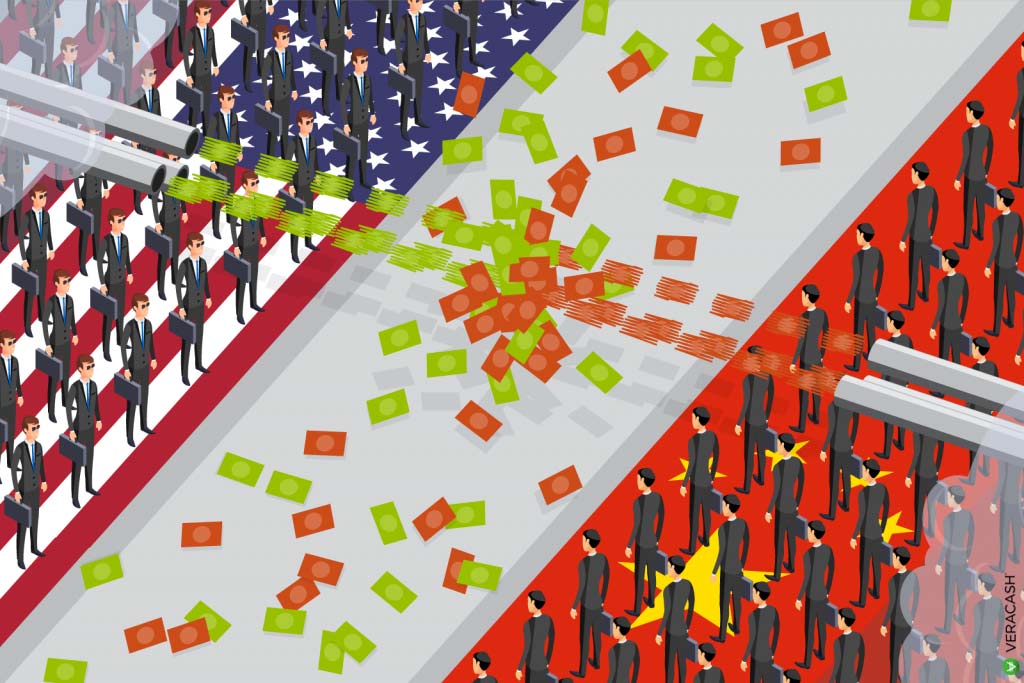

How can we prepare for the currency war?

Once you realize that the States can wage war against one another by means of liquidity injections and quantitative easing, you will find there is cause for concern.

23 July 2019

Who creates money?

What is fiat money? What is bank money? What is money creation? Find all the answers in this article.

29 April 2019

A safe asset in high financial demand

Despite an official discourse that tries to discredit investment gold and keep it away from savers, one cannot help but notice the growing appetite of institutions for this safe-haven asset that they…

12 December 2018

VeraCash Youth Accounts: the stars of the 2nd edition of VeraCash AfterWork ?

On November 30th, VeraCash announced the launching of youth accounts during its annual afterwork event. More details about this new feature in the article!