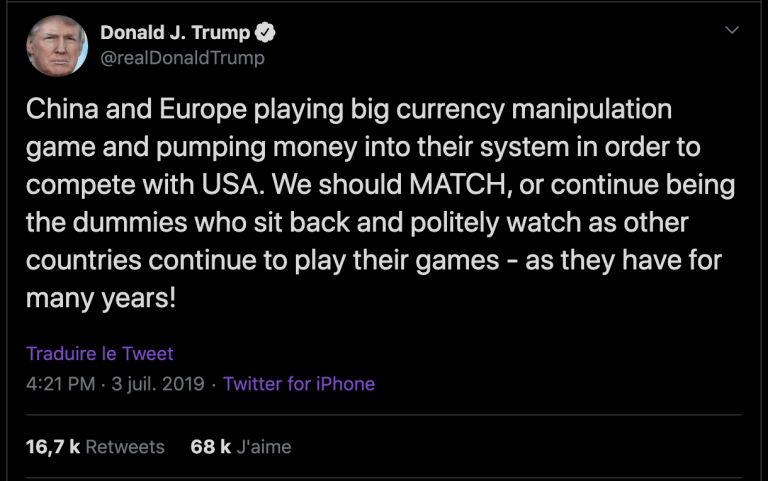

On 31 July, the Fed, contrary to all (or almost all) expectations, lowered its policy interest rates by 0.25 points (to below 2.25%). This decision was made as a result of constant pressure from Trump, who had himself accused Europe and China of manipulating the dollar by devaluing their own currencies.

Trump does not like to be in the hot seat (whereas Mario Draghi, President of the ECB, positively denied any attempt to compete with the dollar), so when Trump feels like he is on the spot, he takes action accordingly. By weakening the dollar through low policy interest rates, he imagines that global exchanges in dollars will flow more freely. This makes sense in theory, since the currency does become more accessible, but in practice, things are more complicated than that.

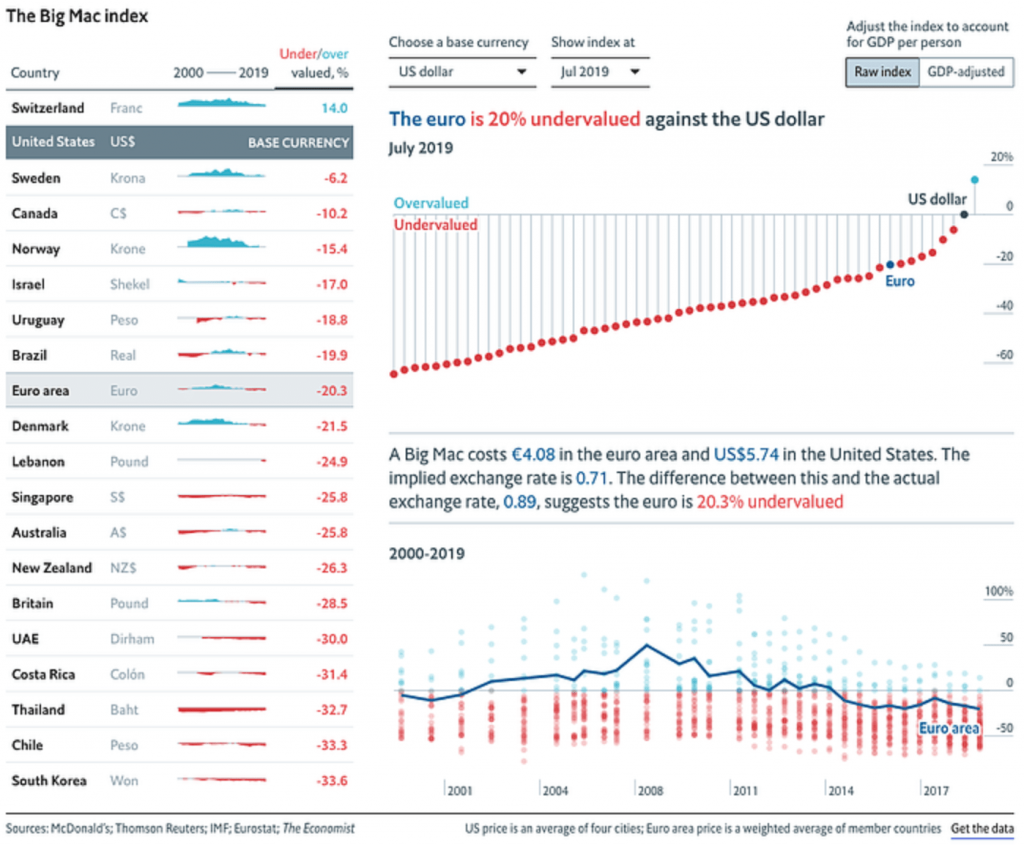

Reduced policy interest rates alone are not enough to lower the value of the dollar: in fact, it is at its highest since 2002, and a simple look at The Economist’s Big Mac index reveals that (nearly) all currencies are below the dollar.

Invented in the 1980s by the magazine The Economist, that index compares purchasing power in different countries in relation to the Big Mac, probably the most popular hamburger at the fast food giant McDonald’s. By comparing the cost of that burger in the US ($5.74) to its cost in other countries, this index identifies currency values in relation to the dollar.

As you can see, the euro was valued at 20.3% less than the dollar in July 2019. If competition was perfect around the world then, based on this index, $1 would be equivalent to €0.71, although in reality it is €0.89.

To weaken the dollar, the United States would need two things to happen: the US Treasury would have to sell off dollars in bulk (something which has not occurred since 1995), and the other countries would have to play along in a coordinated effort, because the foreign exchange market (Forex), traded at $5 trillion per day, is too extensive for the United States to have any unilateral impact on it. But the other countries will not play along, because none of them want a strong currency. We saw this only recently when China enacted the law of talion (an eye for an eye) by depreciating its currency, the renminbi, even further, which destabilized the markets and increased the price of gold to $1,472 per ounce.

Thanos Vamvakidis, global head of the Forex branch of Bank of America Merrill Lynch, spoke out on this subject: “They cannot affect the borrowing cost because interest rates are historically low, so the only way they can ease further monetary conditions is to weaken their currency. However, it’s about equilibrium because when everybody is doing it, then currencies don’t really move, you don’t benefit anything because you end up wasting very limited monetary policy ammunition without much of a result. So in a way, we are in a currency war, although nobody has admitted it.”

What are our alternatives?

Once you realize that the States can wage war against one another by means of liquidity injections and quantitative easing, you will find there is cause for concern. This is all the more true given that certain alternatives are based on the currencies in question: just think of Facebook’s Libra, whose underlying asset is a basket of fiat currencies. In the event of a currency war, what would happen to the Libra?

Nowadays, many investors looking for safe ways to protect their capital are turning towards gold, which pays no interest, unlike bonds which lose them money if kept until the expiration date.

If fiat currencies were to experience a radical drop in value tomorrow, that would have no impact on gold, because gold and currencies are two types of assets which are completely unconnected: only the value of gold is expressed in a currency. It does not take long to understand that the difference between gold and paper money is that gold possesses virtues which paper money never will: it has an intrinsic value, it is non-oxidizing, it has a limited quantity, etc. If fiat currencies lose value, it is likely that consumers will naturally abandon the euro, the dollar, and so on, and they will turn their trust towards another instrument for their exchanges. No one can do without money: we all have to eat, clothe ourselves, and so on. In this case, you can bet that we will turn to gold. The proof lies in the fact that, when we need cash money, we sell off our gold jewellery first.

Brand & Content Manager chez Veracash.

Curieux de tout et en particulier d'Économie, de ses transformations et de l'impact qu'elle a sur nos sociétés.

Toutes les questions méritent une réponse, avec recul et pédagogie.

You might be interested in

5 January 2021

VeraCash is committed to fundraising to strengthen its reputation as an atypical neobank.

Don't pull your hair out! Because we know that our clients come to us mainly from the perspective of "nonbanking", we would like to reassure you…

1 October 2020

FinCEN Files: A swirl of revelations about banks and money laundering

FinCEN Files, the scandal making banks tremble. VeraCash reviews the abuses in the banking system and the systematic circumvention of regulations.

12 September 2019

Money Heist: A lesson on money from the Professor

What happens if the financial institution or the government should waver? The Professor is gambling on the assumption that the Bank of Spain will not…