- Home

- Gold price

- Why is the gold price falling?

Why is the gold price falling?

Gold is not a very volatile asset. But its price is flexible, so it can fluctuate up and down. Why and how does the price of gold fall? The role of inflation, interest rates, the gold industry and consumers: all the answers from VeraCash.

The main reasons for the fall in the gold price

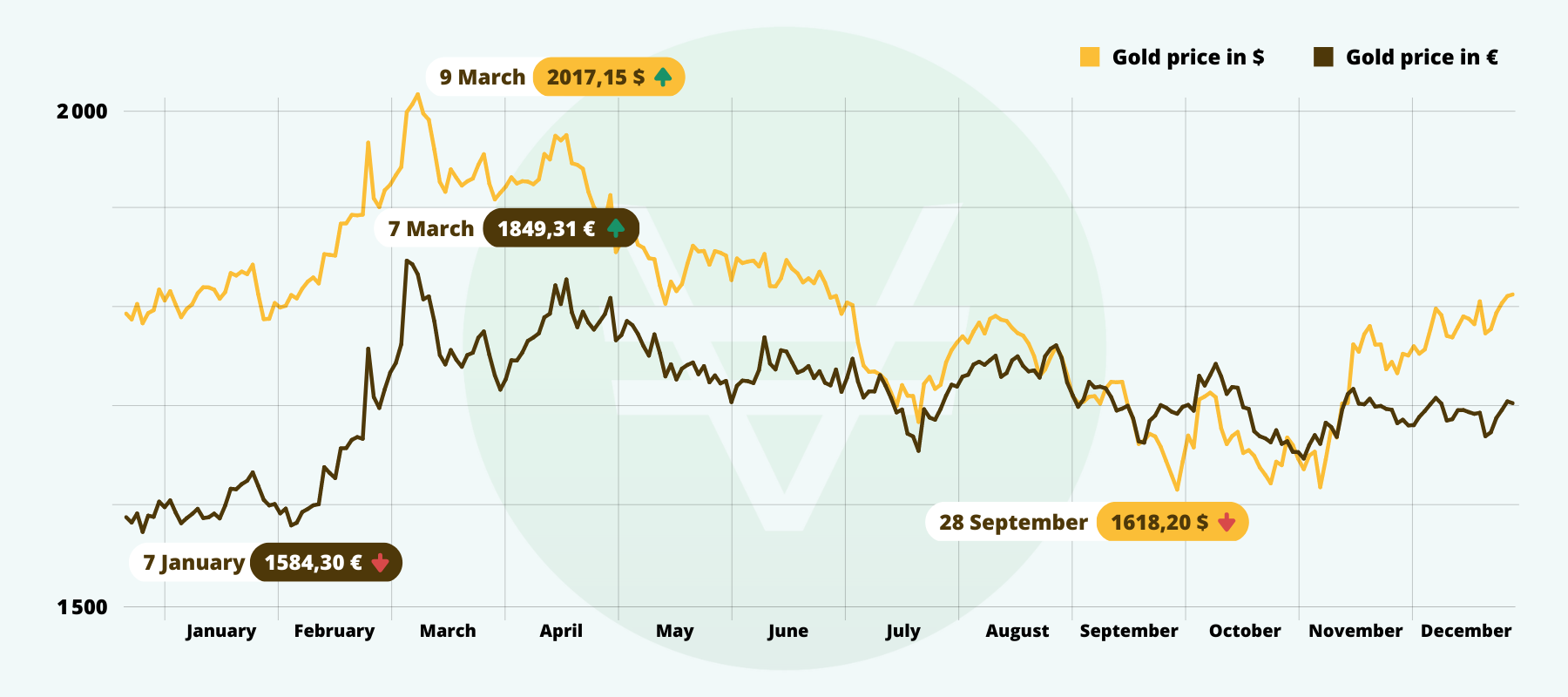

Gold is an asset that is subject to multiple underlying forces. These forces can have opposing effects, giving gold a relatively stable price over the long term. However, if you zoom in on the price curve for an ounce of gold, you can see that there are periods when the price rises and periods when it falls.

The price of gold is flexible!

Since the end of the Bretton Woods Agreement and the end of gold/dollar convertibility, prices have been unrestricted. In mid-August 1971, Nixon decided to put an end to this system, which fixed the ounce of gold at 35 dollars. From 1965 onwards, France’s actions under de Gaulle – who decided to convert the Banque de France’s dollars into gold – and the UK’s similar move in 1971, would have had the upper hand on the US President’s patience. Since then, the market and precious metals professionals have set the price of gold.

The influence of professionals on the falling price of gold: jewellers, manufacturers.

When gold is expensive, jewellers and manufacturers (telecoms, electronics, etc.) find themselves having to pass on this cost in the selling price of their jewellery or equipment. These increases are not good for business development. As part of the gold price is set by the London Bullion Association (LBMA), prices fall fairly quickly. It’s a question of market balance. And the approach is the same for manufacturers, even though gold is less widely used than silver, platinum or palladium in the automotive, electronics or photovoltaic industries. This is the price of physical gold, the metal, not paper gold.

And the mines?

This is a rather unusual situation. If the price per gram of gold is high, you can imagine that it’s good for those responsible for mining the ore. They have more resources for more expensive exploration. But, as Francis Cabrel sings, “it’s all a question of balance“. So if the ore is more expensive, the gold that is smelted or processed is also more expensive. The finished product, a piece of jewellery, will not be sold. Here too, when the price of gold is too high, it will naturally fall to maintain the balance of the entire gold industry.

Gold down: everything’s fine, Madame Marquise

We’re all familiar with the deeper meaning of this popular song. But in fact, when everything is going well in the world, the price of gold falls. In fact, since 1971 it has been possible to track the state of the world economy by looking at the gold price curve.

Lowest between 2000 and 2006

Around the year 2000, the start-up euphoria was in full swing, with money flowing freely around the financial world. Gold has been in decline for quite some time since the end of the inflationary period of the 1980s. And the price of an ounce hit a low of $260 in 2004. In euros (the new currency), the price reached a low of 290 euros in 2001.

A further fall between 2015 and 2018

After the subprime crisis (2008) and the euro crisis (2011/2012), which saw record highs in the price of an ounce of gold in dollars and euros, the price of gold fell slowly but surely. There was a real lack of interest in investment gold. In order to keep inflation below 2%, the printing press is working at full speed. Financiers are investing in the markets, including risky assets such as Bitcoin. The stock market is in great shape! Stock are beating records and shares are paying dividends. Meanwhile, gold is not offering attractive enough returns, so buyers are not rushing in. The price of an ounce of gold is falling and stagnating at around 1,000 euros (and 1,100 dollars). Analysts note that the fall remains limited, since it has not returned to 2004 levels. The gold price has recovered some of the gains made during the crisis, but not all of them. A hurdle has been crossed.

Interest rates go up, gold prices go down!

- When central banks announce a rise in interest rates, the price of gold generally falls. There are two reasons for this:

When interest rates rise, government bonds pick up again, attracting investors looking for a safe, long-term investment. These are, of course, the characteristics of investment gold, but unlike these bonds or treasury bills, gold does not pay interest (or dividends). Investors can therefore choose between gold and interest-rate investments. In 2023, these 10-year rates are close to 3 to 3.5%. - When the central bank raises interest rates, this is known as monetary tightening. The currency becomes stronger and “worth” more. In practice, it is possible to buy more gold metal, a tangible asset, for the same amount of money. The result is a fall in the price of gold.

Does the price of gold fall with inflation?

Raising interest rates is an anti-inflation weapon. And this strategy lowers the price of gold. Inflation, on the other hand, means higher prices, especially for commodities, including gold. In inflationary times, when interest rates are not rising, the price of gold rises. This is a perfect illustration of the tensions between the different parameters that drive the price of the yellow metal. Inflation leads to a rise. The weapon used to fight inflation, the rise in interest rates, causes a fall. A recent illustration of this phenomenon.

Second half of 2022: the markets had anticipated the rise in rates

Since professional investors took the view from autumn 2022 onwards that US interest rates would not continue to rise, it was inflation that drove the gold price upwards.

May 2023: The European Central Bank continues to raise rates

It’s a bitter blow for euro investors. Christine Lagarde, President of the European Central Bank (ECB), has decided to tighten monetary policy further by raising interest rates. Yet inflation seemed to be easing. The result was an immediate fall in the price of an ounce of gold in euros. On the Fed side, there was a pause in interest rates, but the head of the US Federal Reserve threatened to resume his policy of raising rates.

Should we fear a fall in the price of gold?

The last thing we need is to believe that the price of an ounce of gold will always rise. Like the trees, it doesn’t reach for the sky. Investors familiar with commodities, and precious metals in particular, know that corrections can occur after a sharp rise.

Falling gold prices based on Fibonacci retracement

Some technical analysts, like our partner Tradosaurus, generally call for a Fibonacci retracement after a sharp rise. This formula, named after an Italian mathematician, can be used to predict a retracement, i.e. a fall in a share price, which is calculated as a percentage of the gain. In our expert’s view, the steeper the rise, the greater the correction. For example, a fall with a retracement of more than 50% of the gain is normal, while up to 61.8% is very acceptable.

Buying during sales

Some investors are on the lookout for falls in the price of gold. They look for signals on price charts. This usually results in rebounds, which shows that buyers are taking over from sellers when the price is low. Over the long term, this helps to “smooth out” the price of gold and thus reduce jolts (upwards or downwards).