[/vc_column_text][/vc_column][/vc_row]

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

Is silver a good investment? Is now a good time to buy silver? Why should you invest in silver? All of these are questions that may occur to you when you start considering ‘the poor man’s gold’.

In investment terms, you have probably already heard about the complementarity between gold and silver. The price of silver tends to be correlated with the price of gold, but not in the same way. In fact, the heavy use of silver in industry makes its pricing much more volatile. Given the current economic climate and the continuously rising demand for silver, we have identified nine reasons why you should think about investing in it.

1. An affordable precious metal

It is an affordable investment, within reach of any wallet. Silver currently costs 70 times less than gold: at present, 1 gramme of silver is traded at around EUR 0.51, compared to EUR 45 per gramme of gold. And yet, it provides the same protection as the yellow metal in the event of a crisis. Some investment coins and bullion coins are continuously rising in value, making them an excellent long-term investment.

2. Real value

Silver, like gold, is the ultimate form of currency because it cannot be created from nothing (and therefore depreciated), contrary to paper and digital forms of money. Owning silver means owning a real asset that served as currency for thousands of years. History tells us that silver was used more than gold to make coins, and the fact that silver is less expensive than gold makes it extremely liquid and very readily circulated and traded. It is, therefore, easier to buy consumer goods using silver coins than gold.

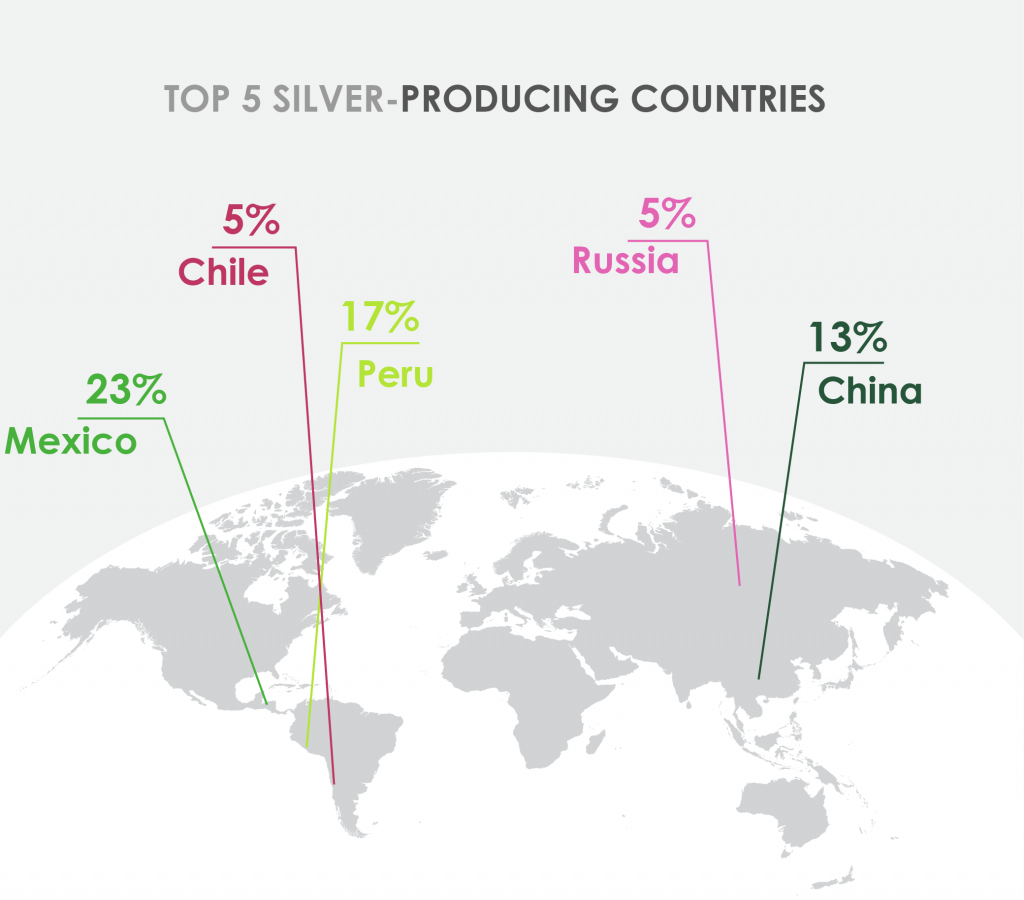

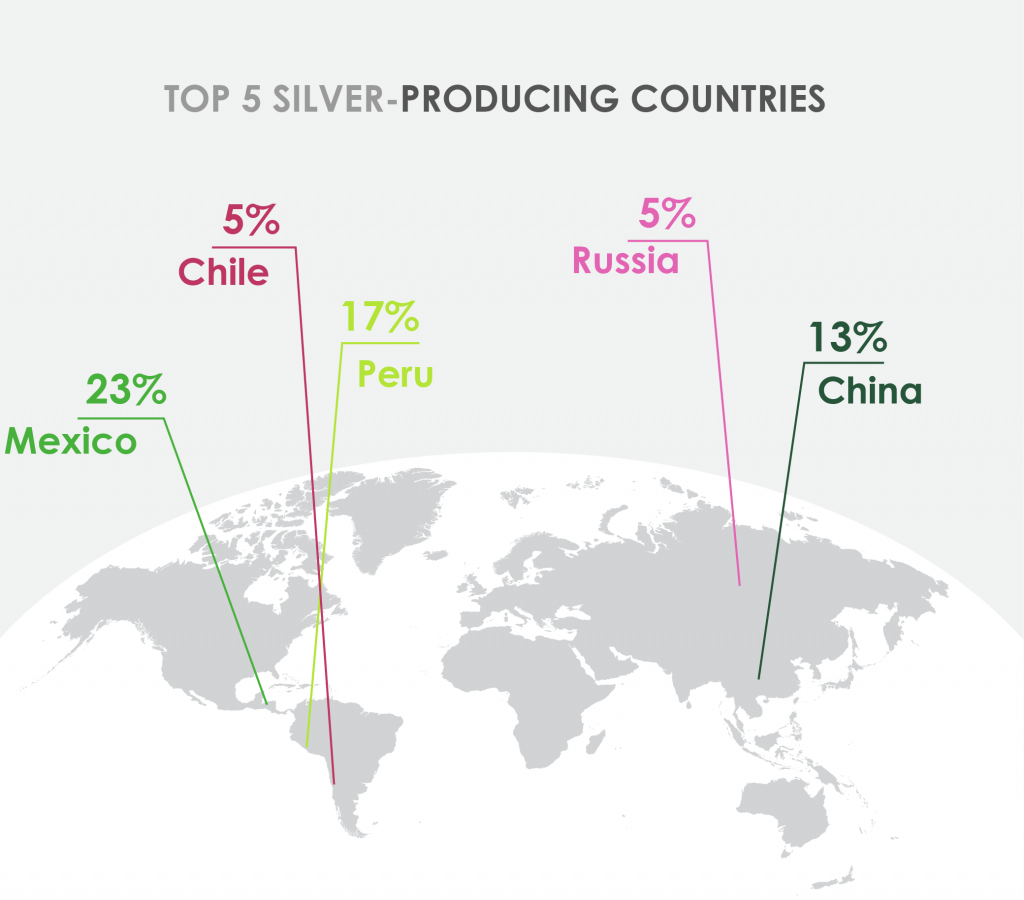

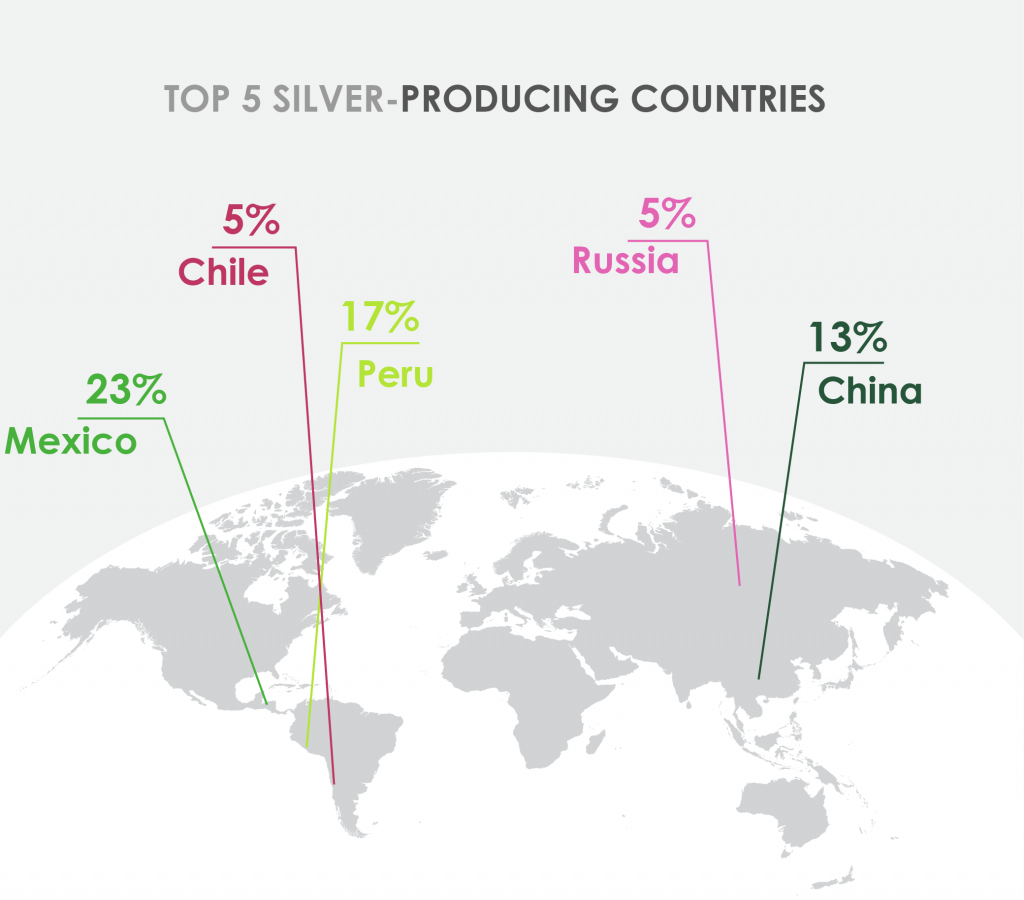

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

Is silver a good investment? Is now a good time to buy silver? Why should you invest in silver? All of these are questions that may occur to you when you start considering ‘the poor man’s gold’.

In investment terms, you have probably already heard about the complementarity between gold and silver. The price of silver tends to be correlated with the price of gold, but not in the same way. In fact, the heavy use of silver in industry makes its pricing much more volatile. Given the current economic climate and the continuously rising demand for silver, we have identified nine reasons why you should think about investing in it.

1. An affordable precious metal

It is an affordable investment, within reach of any wallet. Silver currently costs 70 times less than gold: at present, 1 gramme of silver is traded at around EUR 0.51, compared to EUR 45 per gramme of gold. And yet, it provides the same protection as the yellow metal in the event of a crisis. Some investment coins and bullion coins are continuously rising in value, making them an excellent long-term investment.

2. Real value

Silver, like gold, is the ultimate form of currency because it cannot be created from nothing (and therefore depreciated), contrary to paper and digital forms of money. Owning silver means owning a real asset that served as currency for thousands of years. History tells us that silver was used more than gold to make coins, and the fact that silver is less expensive than gold makes it extremely liquid and very readily circulated and traded. It is, therefore, easier to buy consumer goods using silver coins than gold.

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

Is silver a good investment? Is now a good time to buy silver? Why should you invest in silver? All of these are questions that may occur to you when you start considering ‘the poor man’s gold’.

In investment terms, you have probably already heard about the complementarity between gold and silver. The price of silver tends to be correlated with the price of gold, but not in the same way. In fact, the heavy use of silver in industry makes its pricing much more volatile. Given the current economic climate and the continuously rising demand for silver, we have identified nine reasons why you should think about investing in it.

1. An affordable precious metal

It is an affordable investment, within reach of any wallet. Silver currently costs 70 times less than gold: at present, 1 gramme of silver is traded at around EUR 0.51, compared to EUR 45 per gramme of gold. And yet, it provides the same protection as the yellow metal in the event of a crisis. Some investment coins and bullion coins are continuously rising in value, making them an excellent long-term investment.

2. Real value

Silver, like gold, is the ultimate form of currency because it cannot be created from nothing (and therefore depreciated), contrary to paper and digital forms of money. Owning silver means owning a real asset that served as currency for thousands of years. History tells us that silver was used more than gold to make coins, and the fact that silver is less expensive than gold makes it extremely liquid and very readily circulated and traded. It is, therefore, easier to buy consumer goods using silver coins than gold.

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

Is silver a good investment? Is now a good time to buy silver? Why should you invest in silver? All of these are questions that may occur to you when you start considering ‘the poor man’s gold’.

In investment terms, you have probably already heard about the complementarity between gold and silver. The price of silver tends to be correlated with the price of gold, but not in the same way. In fact, the heavy use of silver in industry makes its pricing much more volatile. Given the current economic climate and the continuously rising demand for silver, we have identified nine reasons why you should think about investing in it.

1. An affordable precious metal

It is an affordable investment, within reach of any wallet. Silver currently costs 70 times less than gold: at present, 1 gramme of silver is traded at around EUR 0.51, compared to EUR 45 per gramme of gold. And yet, it provides the same protection as the yellow metal in the event of a crisis. Some investment coins and bullion coins are continuously rising in value, making them an excellent long-term investment.

2. Real value

Silver, like gold, is the ultimate form of currency because it cannot be created from nothing (and therefore depreciated), contrary to paper and digital forms of money. Owning silver means owning a real asset that served as currency for thousands of years. History tells us that silver was used more than gold to make coins, and the fact that silver is less expensive than gold makes it extremely liquid and very readily circulated and traded. It is, therefore, easier to buy consumer goods using silver coins than gold.

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

Is silver a good investment? Is now a good time to buy silver? Why should you invest in silver? All of these are questions that may occur to you when you start considering ‘the poor man’s gold’.

In investment terms, you have probably already heard about the complementarity between gold and silver. The price of silver tends to be correlated with the price of gold, but not in the same way. In fact, the heavy use of silver in industry makes its pricing much more volatile. Given the current economic climate and the continuously rising demand for silver, we have identified nine reasons why you should think about investing in it.

1. An affordable precious metal

It is an affordable investment, within reach of any wallet. Silver currently costs 70 times less than gold: at present, 1 gramme of silver is traded at around EUR 0.51, compared to EUR 45 per gramme of gold. And yet, it provides the same protection as the yellow metal in the event of a crisis. Some investment coins and bullion coins are continuously rising in value, making them an excellent long-term investment.

2. Real value

Silver, like gold, is the ultimate form of currency because it cannot be created from nothing (and therefore depreciated), contrary to paper and digital forms of money. Owning silver means owning a real asset that served as currency for thousands of years. History tells us that silver was used more than gold to make coins, and the fact that silver is less expensive than gold makes it extremely liquid and very readily circulated and traded. It is, therefore, easier to buy consumer goods using silver coins than gold.

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

Is silver a good investment? Is now a good time to buy silver? Why should you invest in silver? All of these are questions that may occur to you when you start considering ‘the poor man’s gold’.

In investment terms, you have probably already heard about the complementarity between gold and silver. The price of silver tends to be correlated with the price of gold, but not in the same way. In fact, the heavy use of silver in industry makes its pricing much more volatile. Given the current economic climate and the continuously rising demand for silver, we have identified nine reasons why you should think about investing in it.

1. An affordable precious metal

It is an affordable investment, within reach of any wallet. Silver currently costs 70 times less than gold: at present, 1 gramme of silver is traded at around EUR 0.51, compared to EUR 45 per gramme of gold. And yet, it provides the same protection as the yellow metal in the event of a crisis. Some investment coins and bullion coins are continuously rising in value, making them an excellent long-term investment.

2. Real value

Silver, like gold, is the ultimate form of currency because it cannot be created from nothing (and therefore depreciated), contrary to paper and digital forms of money. Owning silver means owning a real asset that served as currency for thousands of years. History tells us that silver was used more than gold to make coins, and the fact that silver is less expensive than gold makes it extremely liquid and very readily circulated and traded. It is, therefore, easier to buy consumer goods using silver coins than gold.

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

Is silver a good investment? Is now a good time to buy silver? Why should you invest in silver? All of these are questions that may occur to you when you start considering ‘the poor man’s gold’.

In investment terms, you have probably already heard about the complementarity between gold and silver. The price of silver tends to be correlated with the price of gold, but not in the same way. In fact, the heavy use of silver in industry makes its pricing much more volatile. Given the current economic climate and the continuously rising demand for silver, we have identified nine reasons why you should think about investing in it.

1. An affordable precious metal

It is an affordable investment, within reach of any wallet. Silver currently costs 70 times less than gold: at present, 1 gramme of silver is traded at around EUR 0.51, compared to EUR 45 per gramme of gold. And yet, it provides the same protection as the yellow metal in the event of a crisis. Some investment coins and bullion coins are continuously rising in value, making them an excellent long-term investment.

2. Real value

Silver, like gold, is the ultimate form of currency because it cannot be created from nothing (and therefore depreciated), contrary to paper and digital forms of money. Owning silver means owning a real asset that served as currency for thousands of years. History tells us that silver was used more than gold to make coins, and the fact that silver is less expensive than gold makes it extremely liquid and very readily circulated and traded. It is, therefore, easier to buy consumer goods using silver coins than gold.

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold

Gold and silver are the dynamic duo of complementary safe investment instruments for your savings and your capital! Although gold is more of a long-term asset, the same can also be true of silver, which furthermore offers the advantage of even better liquidity than gold. Because of its lower value, silver can be stored at home. As a result, the most prudent option is to have both. In addition, silver was historically correlated with gold, even though investors have neglected it in recent years as a result of there being overproduction. There are now real opportunities during this period of readjustment.

[/vc_column_text][/vc_column][/vc_row]

Is silver a good investment? Is now a good time to buy silver? Why should you invest in silver? All of these are questions that may occur to you when you start considering ‘the poor man’s gold’.

In investment terms, you have probably already heard about the complementarity between gold and silver. The price of silver tends to be correlated with the price of gold, but not in the same way. In fact, the heavy use of silver in industry makes its pricing much more volatile. Given the current economic climate and the continuously rising demand for silver, we have identified nine reasons why you should think about investing in it.

1. An affordable precious metal

It is an affordable investment, within reach of any wallet. Silver currently costs 70 times less than gold: at present, 1 gramme of silver is traded at around EUR 0.51, compared to EUR 45 per gramme of gold. And yet, it provides the same protection as the yellow metal in the event of a crisis. Some investment coins and bullion coins are continuously rising in value, making them an excellent long-term investment.

2. Real value

Silver, like gold, is the ultimate form of currency because it cannot be created from nothing (and therefore depreciated), contrary to paper and digital forms of money. Owning silver means owning a real asset that served as currency for thousands of years. History tells us that silver was used more than gold to make coins, and the fact that silver is less expensive than gold makes it extremely liquid and very readily circulated and traded. It is, therefore, easier to buy consumer goods using silver coins than gold.

3. Rising demand

The industrial sector is the primary consumer of silver (56%), particularly as regards the ‘green industry’, a sector enjoying both very high demand and very high growth. Silver is also used in traditional industries, like the vehicle industry, as well as in cutting-edge sectors, such as nanotechnologies and medicine. Global demand is also rising continuously, particularly in China and India, where silver is used to make jewellery and offerings. In fact, demand in India increased by more than 600% in the space of four years! Over that same period, the price of gold remained stable… Another example is mobile phones, which contain an average of 333 milligrammes of silver. According to the French consumption disparity index, 1.7 billion smartphones were sold worldwide in 2018. This equates to 510 million grammes—or 17,989,720 ounces—of silver used solely for telephones.

4. Complicated mining and recycling processes

There has been a significant decline in investment in exploring and prospecting for new deposits. Mining companies have, in fact, been compelled to cut their costs in order to still make a profit.

According to figures released by The Silver Institute, extraction of silver decreased in 2017, a trend which continued in 2018 – something which hadn’t happened in 14 years. Around the world, 0.77 kg of silver ore is produced each second, meaning 24,258 tonnes of the precious metal a year. Silver is a non-renewable resource that is in danger of running out over the next few years, given its current pace of extraction. Very little silver is recycled today because, when used in small quantities—such as in smartphones, for example—the recycling process is simply too costly and complex.

5. Scarce supplies

Silver is a precious metal that is becomingly increasingly rare. All the silver that currently exists (777,275 tonnes) plus all the silver lost throughout history (634,199 tonnes) could be contained within a 52 m3 cube.

6. Devalued pricing

According to most experts, the price of silver is significantly undervalued. This is primarily due to its role as an industrial raw material. The production ratio that has served as a gauge for the value of silver in relation to gold for millennia is no longer 16 to 1. In 2017, only 25,000 tonnes of silver were produced, compared to 3,150 tonnes of gold, for a ratio reduced to just 8:1. Based on that ratio alone, the value of silver should be double what it is today.

7. An asset that does not get confiscated

It is difficult for authorities to confiscate silver. Silver is consumed in large quantities for industrial purposes, but there are no official silver reserves in the bank vaults, as there are for other investment assets.

8. A sound investment for the short or long term

Silver makes for an excellent long-term investment. Given its scarcity and the continuous industrial need for it, demand will always be sustained, and its price is likely to increase over the next few decades.

Silver also offers great short-term investment prospects: because it is more volatile than gold, any informed investor can make capital gains by seizing good purchasing opportunities.

9. Complementarity with gold