INFORMATION – Youth accounts are currently unavailable. The details presented here are for information purposes only.

Build up your golden savings from a young age.

Already a VeraCash member? Create an account for your child over 13 years of age

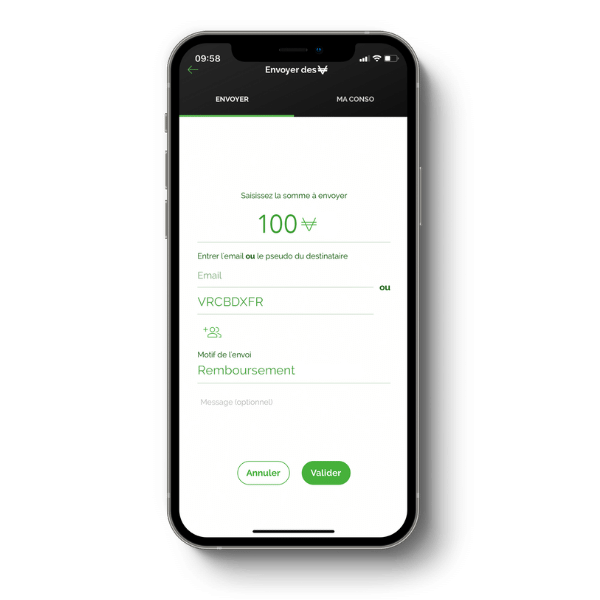

Give pocket money free of charge

With VRC’s remittance function, you can send precious metal as pocket money to your children at no cost. No exchange rate is applicable as VeraCash is backed by gold and silver.

Give them financial independence

For more autonomy, many advantages are offered to young people who benefit from a VeraCash youth account. These include access to a personalised IBAN, a currency exchange and a free payment card.

By default, the card is capped at 20 VRCs/day but you can manage the limit.

Build your early savings

Each profile has its own VeraCash account: do you prefer to release funds once your child has started working? Save for their education? Let them pay for their expenses? The VeraCash youth account is adaptable, but above all, it is empowering!

Discover the story of Régis Chaperon

This story tells of the handing down from generation to generation of an inheritance, which today is worth only a few cents... The inheritance bequeathed by this grandfather would have been worth much more today if it had been made of gold.