An innovative account for businesses

Give your business the cash flow it deserves, backed by 100% physical gold and silver metal

Secure your cash flow with precious metals

Turn some of your cash into precious metals to regain independence and stability. As with Personal Accounts, the gold is physically stored in safes and can be used at any time with the payment card associated with the account. Through the possession of physical gold, the storage of value in safe deposit boxes does not fall within the scope of regulations on the seizure of bank savings in case of need.

Gold is an investment that can be considered over the long term with a view to wealth and security. In particular, it has done well and played its role as a safe haven during the last economic crises, such as in 2008, 2011 and 2020.

Note: Gold’s previous performance cannot be taken as an indication of favourable performance in the future.

Integrate gold into your accounting easily

Easily integrate your precious metals into your accounting.

Special provisions for self-employed persons

No entries need to be made. The purchase and sale of gold and silver bullion coins is not part of your professional activity, even if the purchase is made through your business bank account.

General provisions

Depending on the use you wish to give to your VeraCash business account, it can be considered as :

Payment account

In this case, your VeraCash account will count as a bank or financial institution account or payment method.

Savings account

In this case, your VeraCash account is managed in a similar way to an investment securities account.

Please note: the VeraCash corporate account involves holding gold and other precious metals, not fiat currency. You should be aware of potential changes in the value of your assets, especially at the time of accounting closings. We encourage you to consult your accountant in order to integrate gold in your accounting.

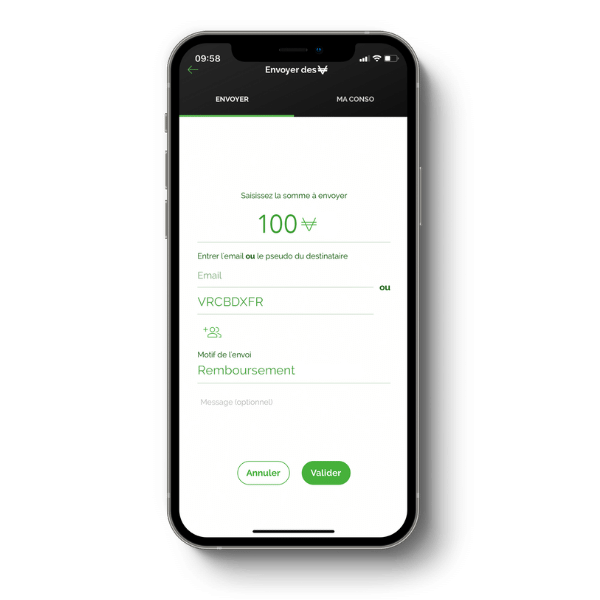

Simplify your transactions

Send, exchange or transfer VeraCash’s currency, VRC, free of charge and instantly to your suppliers and employees.

Reward your employees and pay your suppliers in VRC. By introducing an internal currency within your company, you promote networking and collaboration.

Frequently Asked Questions

What documents do I need to send to open a VeraCash business account?

In order to open a VeraCash business account, you must provide a copy of your ID, a copy of your bank details, proof of address less than 3 months old, Certificate of incorporation and the statutes of your company.

Is there a difference between VeraCash business and personal account?

For the time being, there is no difference between a business VeraCash account and a personal VeraCash account.

Is my business account subject to inactivity fee?

Like any other type of account on VeraCash, your business account is subject to inactivity fee after six months of no activity.